Investors expecting the stock market to build on the robust start it’s seen in 2019 don’t have history on their side.

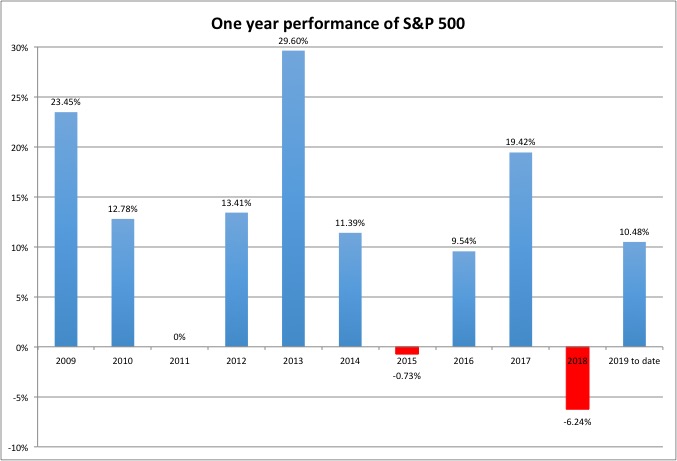

A lot will have to go right to continue the best market start in 32 years. After all, the year-to-date gain, which eclipsed 10 percent for the S&P 500 during Friday’s rally, is already better than what the index typically sees over an entire year.

Recent years in this bull market, though, have shown that outsized gains are possible. In 2017, the market jumped 19.4 percent, 2013 saw a 29.6 percent surge and 2009, the year that saw the crisis bottom, ended with the S&P 500 up 23.4 percent.

But someone looking to jump into the market now and expecting to make money by the time the calendar rolls over 2020 will need the following stars to align: positive U.S.-China trade talks, continued reluctance by the Federal Reserve to raise interest rates, and the economy and corporate profits to stay out of recession, just to name three.

The market was in a funk during the fourth quarter of 2018 that began with Fed fears and ended with a blowout selling frenzy that resulted in the worst Christmas Eve in Wall Street history.

By CNBC News